We worked with a fintech platform that helps clients manage their investments by accurately matching customers with the financial institutions that suit their financial needs. We worked with them to build a Heroku platform, from back-end to front-end, to support their business model with an accurate Salesforce Integration.

Need: End-to-End Product Development and Salesforce Integration

Our customer sought a solution that would provide a responsive UI to engage customers and implement their business model effectively. Oktana was brought on to assist them in building and developing the entire platform from scratch while ensuring the safety of sensitive financial data.

Solution

We started with a Heroku pipeline to handle multiple environments. Then we used preview apps for open pull requests and the development, staging, and production environments. We created a Node.js server on Heroku which connected with an API built by our customer. Node.js was also used to establish a security layer and to communicate with Salesforce. A Github integration made the development process simple, and each task created a new branch on Github. We additionally implemented a ReactJS project for the team that lived outside of Salesforce.

The main features added to the platform in this project throughout multiple release stages were:

- Goal Creation: Users can create personal financial goals by registering their financial information and personal data to plan for purchasing real estate, travel, retirement, education, and many more subcategories.

- Risk Profiles: our partner determines potential risks in meeting your goals based on simple questionnaires.

- Recommendations: Based on user goals and current status, they inform users if they are on-track, at-risk, or off-track and provide recommendations to meet their goals.

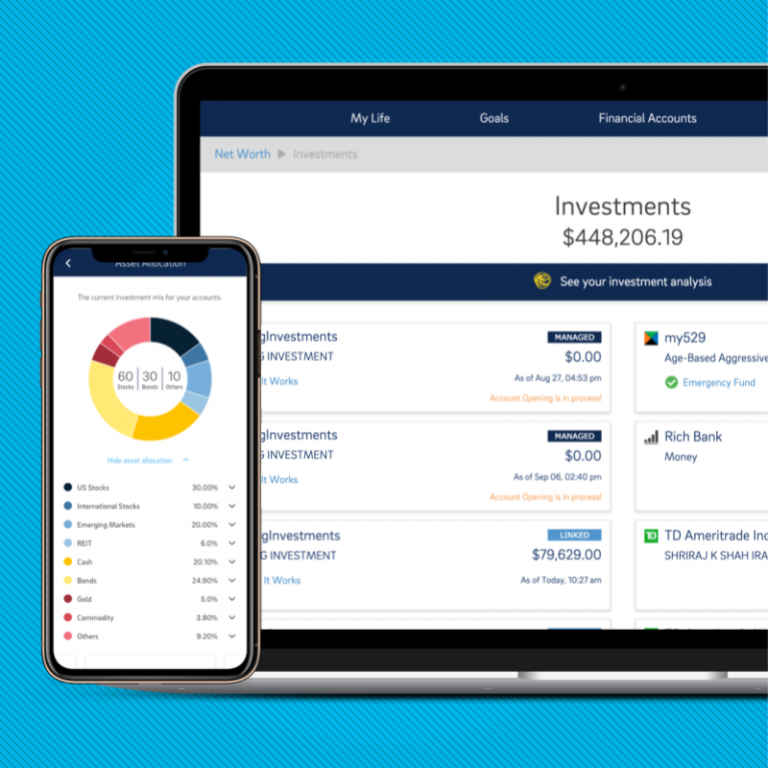

- Account Linking: Users can link external bank accounts (such as Paypal, CitiBank, and Santander) to track all finances within their platform. This data is then displayed in dynamic graphs to simplify users’ understanding. These accounts are linked to specific goals to show risks and recommendations.

- Investment Analysis: Detailed analysis of investments using dynamics graphs, which involves asset allocation, stock concentration, and fund fees.

- Plan with an advisor: Annually, a user can schedule a call with a financial advisor. This option opens a calendar to schedule the call in real-time.

- Spending Analysis: This feature gives the user the option of analyzing their spending by month in categories and transactions, as well as spending trends to compare their expenditures.

- Financial Wellness Coach: Created to motivate the user to commit to their finances. By collecting user data and asking additional questions, provides a financial wellness score from 0 to 500 and recommendations on how to best manage personal finances.

- Smart Budget: Allows budget creation with associated accounts. This environment allows 12 buckets, or categories, to organize budgeting. It is also possible to manage it monthly, for one month or the whole year. It also shows expenditures and transactions.

- Notification Center: This feature gives the user a place where they can centralize and manage notifications. These are synchronized with the push notifications they receive on in-app.

- Transaction Group Manager: This feature allows the user to group different transactions with the end goal of providing user-friendly data analysis.

Results

Our partner’s new functionalities promote smarter planning, investing and spending decisions. It brings together the benefits of professional financial advisors and digital finance advice. Moreover, it offers tailored financial education, as well as personalized goals-based planning, automated investing, debt reduction, progress tracking, spending analysis, and budgeting.

These new features, particularly the launch of Smart Budget, have enabled our customer to aim to become the leading revolutionary financial wellness platform for the Fortune 1000.

Read more about Heroku: Simplify and improve your cloud infrastructure.